Setting Up FNBM Account Alerts in Online Banking

May 15, 2024

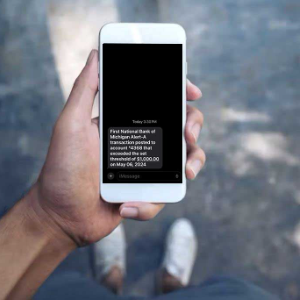

In the digital age, managing your finances efficiently is more accessible than ever, thanks to the convenience of FNBM online banking. One of the most valuable tools available to our account holders is the ability to set up bank account alerts. These alerts can help you stay informed about your account activity, avoid overdraft fees, and even protect against fraud. Here’s a comprehensive guide on setting up bank account alerts in online banking.

Why Set Up Bank Account Alerts?

Before diving into the setup process, it’s important to understand the benefits of bank account alerts:

- Fraud Prevention: Alerts can notify you of suspicious activities, such as large withdrawals or purchases, helping you detect and respond to potential fraud quickly.

- Budget Management: Receive notifications when your balance falls below a certain threshold or when large transactions occur, aiding in better budget control.

- Avoiding Fees: Alerts for low balances and upcoming bills can help you avoid overdraft fees and ensure you have enough funds to cover your expenses.

- Payment Reminders: Set reminders for due dates of recurring payments, ensuring you never miss a bill payment.

Types of Alerts

First National Bank of Michigan offers a variety of alert types to cater to different needs:

- Balance Alerts: Notify you when your account balance falls below or exceeds a specific amount.

- Transaction Alerts: Inform you of transactions over a certain amount, both credits and debits.

- Security Alerts: Alert you of any suspicious or unusual activity, such as failed login attempts or changes to your account details.

- Bill Payment Alerts: Remind you of upcoming due dates for bills and other scheduled payments.

- Deposit Alerts: Notify you when direct deposits, such as payroll, are credited to your account.

How to Set Up Bank Account Alerts

Setting up bank account alerts involves a few straightforward steps.

1.Log In to Your Online Banking Account

• Access your bank’s website or mobile app.

• Enter your login credentials to access your account dashboard.

2.Navigate to Alert Settings

• Look for the section labeled “Alerts”. This is found in the lower right corner of the FNBM mobile app or at the top of the page in FNBM online banking near your profile.

3.Choose Alert Types

• Select the types of alerts you wish to set up. Options include balance alerts, transaction alerts, security alerts, and more.

4.Customize Your Alerts

• Define the criteria for each alert. For example, set a specific balance threshold for low balance alerts or a minimum transaction amount for transaction alerts.

5.Set Notification Preferences

• Decide how you want to receive these alerts. Options include email, SMS, or push notifications via the bank’s mobile app.

6.Review and Confirm

• Review your alert settings to ensure everything is correct.

• Confirm and save your settings.

Tips for Effective Alert Management

• Regularly Review Alert Settings: Periodically check and update your alert settings to ensure they still meet your needs.

• Balance Multiple Notification Methods: Use a combination of email and SMS alerts for redundancy.

• Stay Updated with Mobile App Notifications: FNBM provides real-time push notifications through the mobile app, which can be faster than email or SMS.

Setting up bank account alerts is a proactive way to manage your finances, enhance security, and avoid unnecessary fees. By customizing alerts to suit your financial habits and needs, you can stay informed and in control of your banking activities with ease. Start exploring your FNBM online banking platform today and take advantage of this powerful tool to manage your money more effectively.

For assistance in setting up alerts please contact customerservice@fnbmichigan.bank.

Posted in Security Updates